Scene 21 — 2:08:12

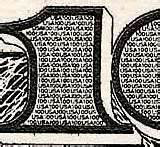

In this scene, Frank Abagnale and Carl Hanratty use a printer’s loupe, a specialized magnifying glass, to study forged checks. (A good magnifying glass magnifies at least 10 times.)

Scene 21 — 2:08:12

It’s not a real loupe — a real printer’s loupe magnifies much more than the household hand lens — but that would confuse the movie-going public. You see it flying over the check for a few seconds and are supposed to think “magnifying glass!”. Showing the literal reality is ugly and would leave the audience befuddled — judge for yourselves!

In such scenes, clarity and prettiness

is chosen over realism. It’s the

same reason why Spielberg chose the arm

of a living person over a genuinely

decomposed, severed arm in that beach

scene with the deputy sheriff in

“Jaws”

(1975): the reality didn’t look

right!

(Stanley Kubrick

said it most succintly: “Real is

good, interesting is better!”)

This is directly linked to the

“suspension of disbelief”,

a crucial ingredient of any movie.

IMDB page on Jaws

—

Wikipedia page on Jaws

To some extent, Hanratty’s and Abagnale’s analysis is part of the forensic discipline called questioned document examination (“QDE”). And why not: with Dexter, we’ve already got a blood splatter specialist on the Miami police force. It just so happens that he’s also… a serial killer.

The objective is to determine whether a document was forged, whether information on it was altered, added or erased, which typewriter or printing press was used to produce the document etc. This forensic science allowed to expose the Hitler Diaries as a hoax, for instance. (Don’t confuse it with the pseudo-science called “graphology”, which tries to find your psychological characteristics by studying your handwiriting!)

Sure, the handwriting was analyzed, but only to ascertain if it could indeed have been Hitler’s longhand. Putting aside the numerous historical inaccuracies, the forensic analysis showed that modern paper and modern ink was used.

And it’s not just nerdy F.B.I. agents that do this sort of thing: there’s actually an “American Society for Testing and Materials” (“ASTM”) that wants to advance the expertise! And they’ll have you know that E30.02 is the Subcommittee for Questioned Documents, and that E2494-08 is the Standard Guide for Examination of Typewritten Items! There are similar standards for paper cuts, tears and perforations and for fracture patterns and paper fibre impressions on single-strike film ribbons and typed text... And, oh, you should also join the “American Society of Questioned Document Examiners” (“ASQDE”) if you’re interested!

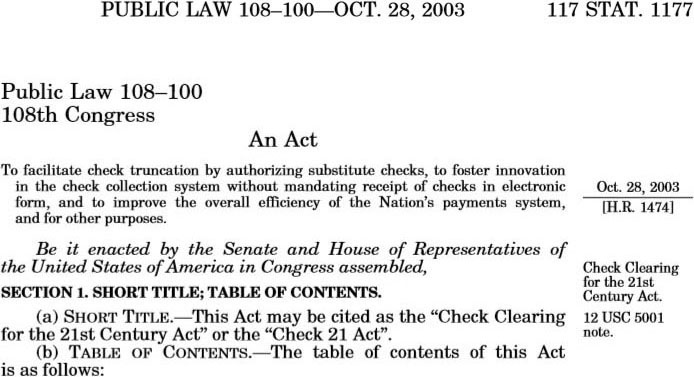

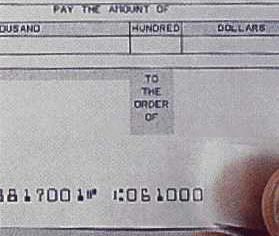

Of course, forensic science can be applied to fake checks too, but that has become much harder the last years. Here’s why: the “Check 21” legislation, short for the “Check Clearing for the 21 Century Act”, voted on 28 October 2003 and effective 1 year later.

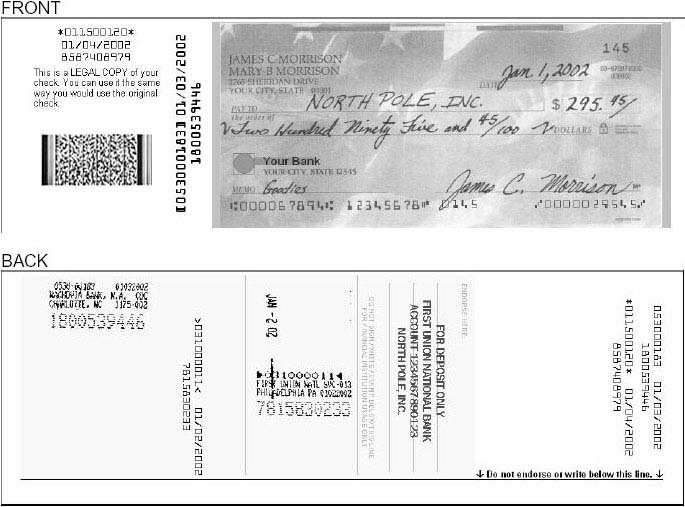

In short, this law introduced “image reproduction documents” or “substitute checks”. The paper reproduction of a check (after its scanning and with some data such as the codeline overlayed in the image) received the same legal value as the original check. Scanned images — understand that check readers typically scan at the low resolution of 240 dpi tops! — now replace the paper document whose every detail one could study with a printer’s loupe...!

The stated objective of the act was to process checks faster — fair enough, it’s in the interest of both the account holder and the bank! — but you can’t ignore the serious drawback. The paper check got removed (“truncated” in legalese) from the check clearing process, the electronic image has taken its place.

Says Abagnale: “[The] substitute check [is] less than helpful than helpful when fraud enters the picture. Since it can’t be used to determine things like pen pressure or to analyze handwriting effectively, it is much less useful in proving forgery or alteration. The actual instrument of the fraud, the original paper check, is typically destroyed — and there goes the evidence.” (book “Stealing Your Life”, page 263)

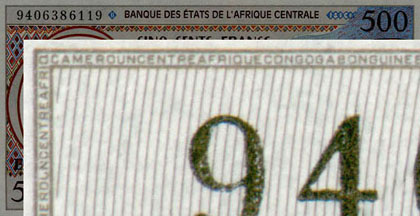

Does the new practice of scanning checks invalidate the security features of the paper check then? Not at all! Indeed, the paper-based security features don’t survive the scanning process. But the purpose of these techniques — rosettes, vignettes, high-resolution borders, thermochromatic ink, microprinting, abrasion ink etc. — is to discriminate real and fake checks before they’re scanned, when they’re presented as payment. As also holds for counterfeit money, security printing allows the educated bank teller, sales clerk in the shop (and possibly you) to recognize a fake check when it’s handed over to them!

Which brings us to microprinting! Abagnale has for instance developed a box for a manufacturer of luxury watches, that cost, say, $15,000 and up, where the microprinting on the box is only visible with a high-magnification lens... (book “Real U Guide to Identity Theft”, page 11)

Most bank notes, traveler’s checks and more than 50% of the personal and business checks in the U.S. contain covert microprinting. (So do many government documents — driver’s licences, passports etc.)

The letters you see magnified here are no bigger than 0.1 mm.! Not only too small to be picked up by a scanner and copier, but also way too small for the normal offset printing press. You can’t get this kind of detail engraved on the printing plate, it doesn’t offer that kind of resolution! Try to reproduce this kind of printing and at best you’ll get a single dot for a character, say, a “W”, or a dotted line for a series of characters such as “United States of America”.

(Often, an occasional typo is introduced in the text that the hurried forger doesn’t notice: when the text “United States of America” is repeated 30 times, the 23rd time, the text would for instance be “Unitod States of America” or something similar...)

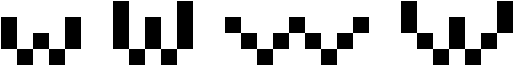

Most people think that a modern image scanner offers sufficient image resolution to pick up details that are much smaller than 1 mm., but that’s wrong. Let’s clear that misunderstanding up quickly!

For normal OCR purposes, a document is scanned at 300 dpi. This unit of measure indicates how many samples are taken per linear inch — 300 in this case. When an image is scanned at 300 dpi, it takes 300 dots to form a line 1” long. Seems like an awful lot, doesn’t it? Well... 300 pixels per 2.54 cm. corresponds to 118 dots per cm., about 12 pixels per mm. Even if you double the image resolution to 600 dpi — photos, pictures etc. are in fact almost always scanned at a significantly lower resolution than documents to be recognized with OCR software —, you’re still limited to 24 pixels per mm.

And now ask yourself the question how many pixels it minimally takes to form an actual character such as a lowercase “w” and an uppercase “W”? See for yourself: pushing aside all aesthetic considerations that make a letter pleasing to read, I’ve created “w” characters with the least possible amount of dots, and — to make it easier on your eyes — I have added an enlarged version. (Sure, you can push your nose against the computer screen, but understand that “anti-aliasing” adds grey pixels to make the letters legible on-screen...)

The smallest recognizable lowercase “w” is 5 pixels wide and 3 pixels high, the smallest uppercase “W” is 5 pixels wide and 4 pixels high. Adding white space between the various letters, how many letters can you squeeze into a surface of 1 mm. scanned at 300 dpi (=12 pixels per mm.) and 600 dpi (=24 pixels per mm.)? Do the math — microprinting is just much smaller than you think and the halftone screens of a regular offset printing press don’t come anywhere near! The printing plates don’t offer the required resolution…

The practice of “washing checks” is explained in this scene: the data of real checks are removed with chemicals and the checks are filled out again. Abagnale and Hanratty discuss the use of bleach, hydrychloride and a new chemical — the (nail polish remover) acetone is suspected.

Abagnale: It’s a real

check.

Hanratty:

[...] It’s been

washed. The only thing original is the

signature.

Abagnale: [...] I mean,

this isn’t hydrochloride or

bleach.

Hanratty: [...]

It’s something new. Maybe

a nail polish remover where the acetone

removes the ink that’s not been

printed.

Abagnale talks about the use of bleach and hydrochloride to erase data on printed documents in detail in his book “The Art of the Steal”: laserprinted checks are easier to forge, because the ink can be removed very easily. Laser printers don’t shoot ink into the paper, they fix toner on the paper.

Now a laser printer is a non-impact printer — in other words, there’s no ink put into the paper. A matrix printer shoots ink into the paper. A jet printer puts ink into the paper. A typewriter puts ink into the paper via the ribbon.

Years ago, […] a forger […] had to extract the ink using bleaches, solvents, acetones, hydrochlorides, polarized chemicals, non-polarized chemicals. He had to take each letter, and do it slowly, or else the check would become abrasive and you’d notice it.

With today’s laser checks, criminals have devised a new methodology. They take a piece of Scotch tape — the gray, cloudy kind that doesn’t rip the paper when you peel it off — and put it over the dollar amount and over the payee name. They use a fingernail to rub it down hard over the check, and then lift off the tape. The toner attaches to the Scotch tape and gets pulled from the fiber of the paper. If there’s any laser toner residue left over, a little high-polymer plastic eraser will take care of that. Sometimes forgers use dental picks, razor blades, or dry ice to remove the toner, but Scotch tape works quite nicely.

It used to be that the only chemical banks had to worry about was bleach. If banks used bleach-sensitive paper, they’d be protected. Today no forger uses bleach. Instead, all sorts of simple chemicals, like acetone, are used to modify checks. What’s the product of choice from which to get acetones? Nail polish remover. It’s 99 percent acetone.

(Nowadays, you can easily find biological alternatives for the highly inflammable acteone nail polish removers!)

Acetone removes anything that’s not a base ink. So the company’s logo, the bank name, the check number, and the borders of the check will stay. But anything that’s typed on or printed on by a laser printer disappears within fifteen minutes. It’s called “washing the check”. (“The Art of the Steal”, pages 39-41)

It is of course smart for a forger to put some Scotch tape over the signature before he washes the check with chemicals! That way, the original signature remains on the check, as Hanratty points out. One of Abagnale’s books spells this trick out word for word.

[The forgers] put a piece of Scotch tape over [the] signature, front and back, and drop [the check] into a cake pan. They pour over it an everyday household chemical [...] that removes all ink from paper except printer’s ink [...]. Thus anything you typed, printed from a computer, or signed with a ballpoint or felt-tip pen dissolves quickly. The criminals can thereby wash off all the information on that check except for your signature. The $109 check you wrote to the electric company comes out to be a blank check signed by you, because the Scotch tape protects the signature from the chemical. They can make the check out to themselves, fill in any amount and cash it. (“Stealing Your Life”, pages 267-268)

Still, much of that type of fraud could be avoided if the check companies weren’t so cheap, according to Abagnale: “Too many companies just use that familiar green or blue basketweave check paper because it’s the cheapest. The companies run it off on the laser printer and they have no controls at all on the paper.” (“The Art of the Steal”, page 47)

To guard against forgers who use chemicals to alter checks, you need to order chemically sensitive paper. You have to ask the printer, “If someone touches it with bleach or ink eradicators, what’s going to happen?” Good paper stock is sensitive to at least nineteen chemicals — chemicals like bleach, acetone, solvents, and hydrochlorides. Whenever these are used to alter a check, the word “void” appears in the background of the paper in three languages, English, Spanish and French. The word should just appear right from behind the paper as soon as you touch it with any of those substances. At the very minimum, the check should change color. It should go from a blue check to a green spot or a brown spot on the check. (“The Art of the Steal”, page 47)

Such paper is called “secure paper stock”. There are only a few paper types available: some paper manufacturers such as Taylor Communications and StockChecks offer secure check stock.

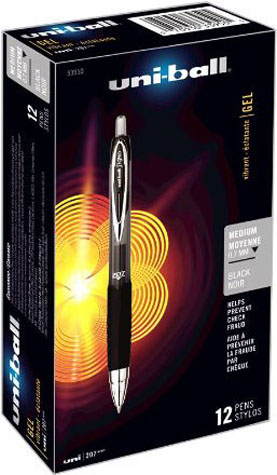

When you’re talking about manually filled out checks, there’s an efficient technique to thwart check washing: use the Signo Uni-ball ballpoints codeveloped by Abagnale!

These pens contain Uni Super ink with pigments that get absorbed into the paper fibers. The ink gets trapped inside the paper and this shows when you try to scratch the paper. (The hybrid ink is also resistant to chemicals that wash checks.)

This is the only “safe” pen — read: unalterable by chemicals and solvents — in the world; some 20 million units are sold in the U.S. each year. A Signo Uni-ball ballpoint costs some $2, refills are available.

Abagnale repeats his advice in his latest book: “I use an inexpensive gel pen, because that ink cannot be washed off. Look for gel pens with specially formulated ink that gets trapped in the paper, which helps prevent criminal check washing and other document alterations.” (book “Scam Me If You Can”, page 58)

I told you about how forgers use Scotch tape to remove information on laser-printed checks. To solve this problem, when you buy laser paper for your checks you need to ask the supplier if it has “toner anchorage”. Sometimes this is called “LaserLock” or “TonerLock”. This is a chemical that is put in the paper during the paper-making process to ensure that documents printed on a laser printer are secure. When the toner is applied, the chemical that is already in the paper is activated by the heat process, and when the chemical and the toner mix, the toner is locked to the paper. It’s impossible to scrape off and tape won’t remove it. (“The Art of the Steal”, page 48)

(Don’t confuse this chemical coating of paper checks with the eponymous CD-ROM copy restriction technique. Toner anchorage can also be called “TonerGrip”.)

Abrasion ink, also called “abrasive ink”, allows you to detect when laser printed text was removed! It’s a white transparent ink that appears grey when rubbed with a coin. Some abrasion inks fluoresce under ultraviolet lighting. Abrasion ink can help indicate when laserprinted text has been picked away. And it is of course difficult to produce and can’t be copied.

Abagnale has a further recommendation that doesn’t require any special technology: “When you print checks, you should remember to use a font that is 12 point or higher. If you use small type, there’s a lot less toner to take off. It’s easier to remove with a piece of tape. If there’s some residue, a forger just uses a bigger font to cover it up. A large font is less likely to be tampered with. It would take a forger all day with Scotch tape to remove the toner, and the process would leave a bigger area to cover up if anything does remain.” (book “The Art of the Steal”, page 49)

And this is a further consideration on check washing. Checks are often typed on a self-correcting typewriter; those typewriters use ribbons that are black and shiny. The black, shiny ribbon is polymer, a type of plastic. You’re putting plastic, not ink, on the check! The white self-correcting tape is a very durable form of coated transparent tape. Ordinary transparent tape can be used to forge such checks: lay the tape over the letters to be removed, rub the tape lightly with a pen or pencil and lift the tape away. The typed letters are now on the tape, no longer on the check!

The solution? Use fabric ribbons, not polymer ribbons. As old-fashioned as they may be, they drive ink into the paper, instead of coating paper with plastic. (Some ribbons are single-strike, others are multi-strike: single-strike ribbons shoot more ink into the paper.)

Abagnale has developed a check that addresses the risk of check washing head on: “People often come us to me and say, ‘You design these secure checks for corporations, why don’t you design a check for me, the consumer?’ So I’m working to produce a secure consumer check. It will have twelve security features, including paper that reacts to twenty-four different chemicals, high-resolution borders that are difficult to duplicate, white ‘chemical-wash detection boxes’ that change colors with chemical tampering and embedded fibers that glow under ultraviolet lights.” (book “The Art of the Steal”, page 55)

“The Art of the Steal” was published in November 2001, which means Abagnale’s personal check has been available for years! It’s called the “SuperCheck” and the company SafeChecks produces it. (Any order you place is checked with your bank.) Three years later, Abagnale created the “SuperBusinessCheck”, it’s also available from SafeChecks.

Here’s a surprising bit of information: paper money gets washed too! “[The forger] goes home and washes the bills in a washing machine with a bleach eradicator that washes all the ink off so they come out as blank bills. He scans a twenty-dollar bill, put the bleached bills in the printer, and ink-jets twenties. Now he’s got real currency with inflated amounts on them. It’s a trick that started in Colombia and has been imported here.” (book “The Art of the Steal”, page 81)

SuperChecks from SafeChecks or not, check guru Abagnale has reserved his position these last years — despite his efforts of many years to make them safer. His about-face is crystallized in his book “Stealing Your Life”. Chapter 9, “My Farewell to Checks”, is the “chapter [he] never expected to write”. (book “Stealing Your Life”, page 256)

He now feels that you should use credit cards instead. Checks contains too much personal information, they constitute an unacceptable risk of identity theft.

The truth is [...] that I rarely write checks anymore, and I don’t feel you should either. It’s just too dangerous. Every check you write to the hairstylist or the cleaner has your name and signature, your bank’s name and address, your account number, and your routing number. Salespeople routinely ask for a driver’s license or work number, as well as other personal information, and scribble that on the check. These days you never get that check back. Was it shredded, or not? Did somebody make a copy of it? Certainly the check front alone contained more than enough information for somebody to draft on your bank account — or to become you.

I’d like to keep that information to myself. I’ve thought long and hard about this point, and my conclusion is, Why would you write a check today?

I prefer to walk into a supermarket and put my purchases on my credit card.

[...] You can’t entirely get away from checks, not yet at least. [...] But it would be much wiser to use a credit card. (book “Stealing Your Life”, pages 257-259)

The chapter ends on this note: “So I’m preaching to those who [...] write a lot of checks to wise up, drastically cut back, and go with plastic rather than paper.” (book “Stealing Your Life”, pages 269)

Then again, the U.S. still see some 39 billion checks written each year…

The paperhanger — slang for “check forger” — discussed by Abagnale and Hanratty does more than washing checks, he also steals checks out of mailboxes. (Legally speaking, he commits mail fraud!) Not amazing, given the American situation where people write checks to pay their bills and send them off in an envelope.

Abagnale describes this situation as follows: “A couple of years ago, four thieves cruised around the more prosperous neighborhoods in South Bend, Ind., as well as communities just over the border in Michigan, look for mailboxes that had their flags up. The guy riding in the passenger seat opened the boxes and sifted through the outgoing mail. When he found someone who had paid their telephone bill or electric bill, he removed those checks from their envelopes and took them. The thieves washed them in nail polish remover, blow-dried them, filled in new names and much higher amounts, and cashed them at local banks. This mailbox caper goes on every day all over the country, usually near the last day of the months when the odds are best of finding checks. Since people generally leave outgoing mail in their mailbox before heading to work, criminals will steal checks in the morning, wash them, and cash them by the afternoon. A lot of the check washers are drug addicts. The same chemicals that they use to cook their drugs, they use to wash checks.” (book “The Art of the Steal”, page 41)

There are lots of scams with mailboxes, the nicest one of which is this.

You come to the bank after-hours deposit box to drop in a deposit. There’s a handwritten sign beneath the box: “Box is out of order. Please leave deposits with security guard.” Standing next to it is a man in a bank security uniform with a four-wheel dolly. He tells you, “I’m sorry, the box is out of order. Just drop your deposits here. I’m with the bank.”

There’s no way I’m going to fall for that. I’ve done it. Thirty-five years ago as a teenager, I pulled the scam myself. I dressed up in a guard’s uniform, put a sign up on a night box at an airport, and said it was out of order. People came by and put their money right in my bag. I made thirty-five thousand dollars in about an hour.

[...] It’s a fairly easy rip-off, because the only props that are required are an “out-of-order” sign, a receptacle of some sort, and a standard issue security guard uniform.

[...] The tip here is quite simple. A box cannot be out of order. (book “The Art of the Steal”, pages 118-119)

And your wardrobe can’t malfunction, we should add!

In his latest book, Abagnale recommends the use of locking mailboxes: “Invest in a mailbox that locks — so that the mail placed there by the mail carrier goes in and stays there until you, and you alone, remove it.” (book “Scam Me If You Can”, page 54)

According to some sources, a scene that showed this scam was cut from the movie. Real people came up to Leonardo DiCaprio dressed as a security guard and tried to give him their money, despite the presence of cameras. Well, maybe. I didn’t find that particular scene in the published screenplay, which does contain some scenes that were cut in the editing room…

Opening titles — Abagnale — Hanratty — Checks — Stationery — Pay checks — Pilot — MICR — Typewriter — Hotel — M.D. — Lawyer — Printing — Arrest — Prison — Sitemap — Search